January 20, 2026/

Most macroeconomic analysis lives at one of two extremes: This project sits somewhere in the middle. I wanted a clear,...

The code below does the following

A copy of the jupyter notebook can be found here

The code below is the libraries used, the function to get stock data, and the ticker_list

# Import Libraries

import pandas as pd

import yfinance as yf

import matplotlib.pyplot as plt

import seaborn as sns

# Function to fetch historical stock prices

def get_stock_data(ticker, start_date, end_date):

stock_data = yf.download(ticker, start=start_date, end=end_date)

return stock_data

# Get Tickers

sp_df = pd.read_html('https://en.wikipedia.org/wiki/List_of_S%26P_500_companies')[0]

sp_df['Symbol'] = sp_df['Symbol'].str.replace(r'\.', '-', regex=True)

tickers_list = list(sp_df['Symbol'])[:]

# tickers_list

# Smaller Test List

# tickers_list = ['AAPL', 'MSFT', 'GOOGL']Below are the summarizing and plotting functions

# Function to create and display a summary of returns

def summarize_returns(results_df):

# Display summary bar chart

plot_bar_chart(results_df)

plot_box_plot(results_df['YTD Performance'])

plot_histogram(results_df['YTD Performance'])

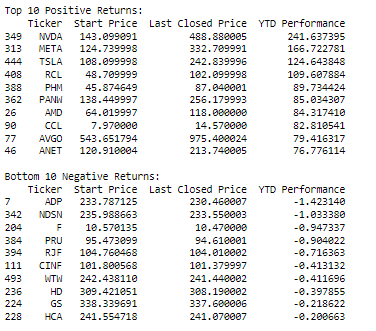

# Sort by YTD Performance in descending order for positive returns and ascending order for negative returns

positive_returns_df = results_df[results_df['YTD Performance'] > 0].sort_values(by='YTD Performance', ascending=False)

negative_returns_df = results_df[results_df['YTD Performance'] < 0].sort_values(by='YTD Performance', ascending=True)

# Display top 10 positive returns

print("Top 10 Positive Returns:")

print(positive_returns_df.head(10))

# Display bottom 10 negative returns

print("\nBottom 10 Negative Returns:")

print(negative_returns_df.tail(10))

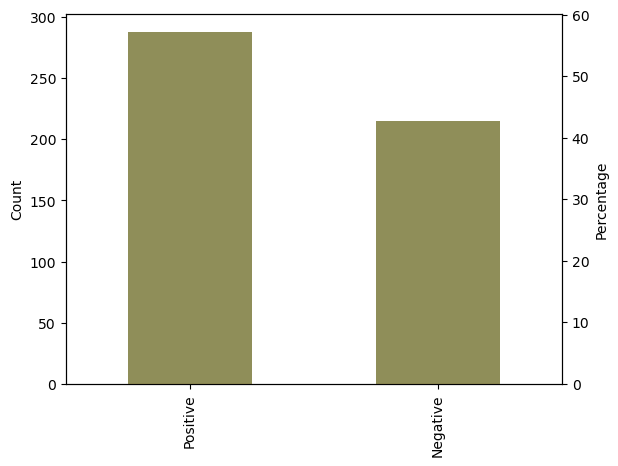

# Function to create a bar chart of YTD returns

def plot_bar_chart(returns_df):

returns_sign = pd.cut(returns_df['YTD Performance'], bins=[-float('inf'), 0, float('inf')], labels=['Negative', 'Positive'])

returns_count = returns_sign.value_counts()

returns_percentage = returns_sign.value_counts(normalize=True) * 100

fig, ax = plt.subplots()

returns_count.plot(kind='bar', ax=ax)

ax.set_ylabel('Count')

ax2 = ax.twinx()

ax2.set_ylabel('Percentage')

returns_percentage.plot(kind='bar', ax=ax2, color='orange', alpha=0.5)

plt.show()

# Function to create a bubble chart of YTD returns

def plot_bubble_chart(results_df):

# Create bins for returns

bins = [-float('inf'), -10, -5, 0, 5, 10, float('inf')]

bin_labels = ['-Inf to -10%', '-10% to -5%', '-5% to 0%', '0% to 5%', '5% to 10%', '10% and above']

# Categorize returns into bins

results_df['Return Bins'] = pd.cut(results_df['YTD Performance'], bins=bins, labels=bin_labels, include_lowest=True)

# Group by return bins and count the number of companies in each bin

return_counts = results_df.groupby('Return Bins').size()

# Create a bubble chart

fig, ax = plt.subplots(figsize=(10, 6))

scatter = ax.scatter(return_counts.index, [1] * len(return_counts), s=return_counts.values * 10, alpha=0.5)

# Add labels and title

ax.set_xlabel('Return Bins')

ax.set_title('Bubble Chart of YTD Returns')

# Add a legend

legend_labels = [f'{bin_label}: {count}' for bin_label, count in zip(return_counts.index, return_counts.values)]

ax.legend(legend_labels, title='Return Range', loc='upper right', bbox_to_anchor=(1.3, 1))

plt.show()

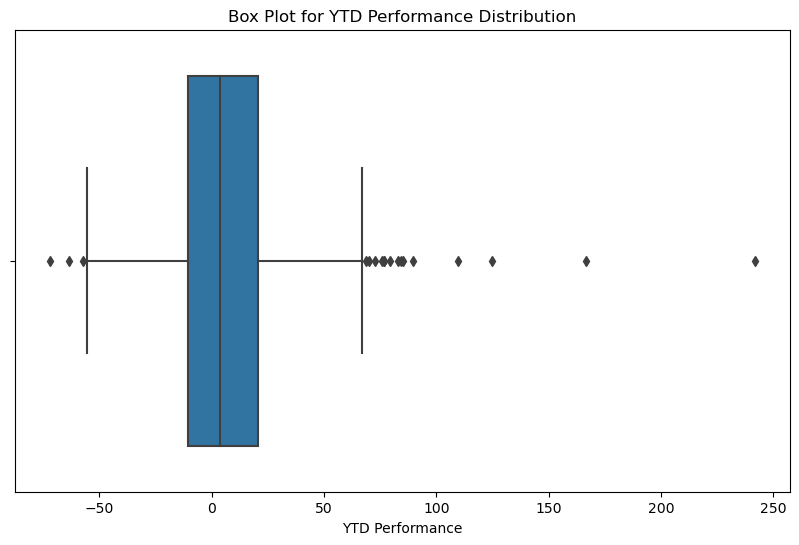

# Function to create a box plot of YTD Perf

def plot_box_plot(ytd_performance):

plt.figure(figsize=(10, 6))

sns.boxplot(x=ytd_performance)

plt.title('Box Plot for YTD Performance Distribution')

plt.show()

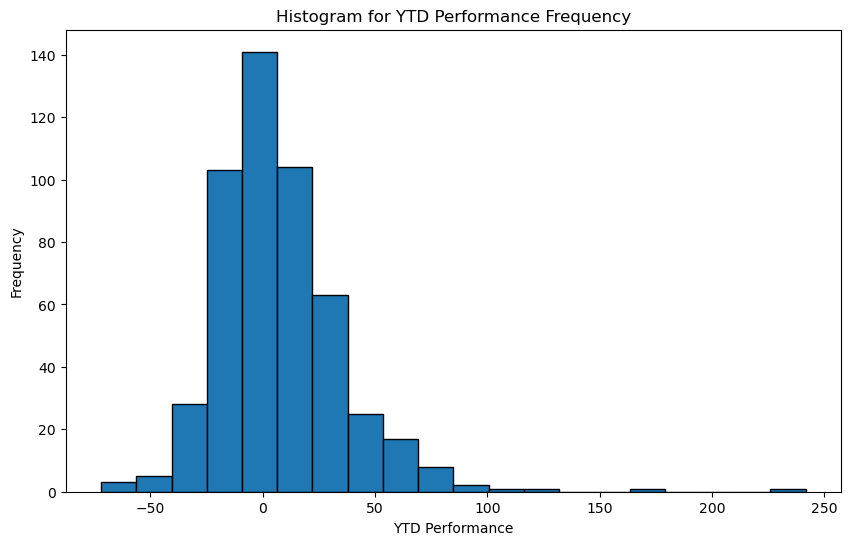

# Function to create a histogram for YTD performance frequency

def plot_histogram(ytd_performance):

plt.figure(figsize=(10, 6))

plt.hist(ytd_performance, bins=20, edgecolor='black')

plt.title('Histogram for YTD Performance Frequency')

plt.xlabel('YTD Performance')

plt.ylabel('Frequency')

plt.show()And the code to run this all

results_df = pd.DataFrame(columns=['Ticker', 'Start Price', 'Last Closed Price', 'YTD Performance'])

# Create an empty list to store individual DataFrames for each company

dfs = []

# Loop through each company, fetch YTD performance, and store the results

for ticker in tickers_list:

stock_data = get_stock_data(ticker, '2023-01-01', '2023-11-16')

start_price = stock_data['Adj Close'].iloc[0]

last_closed_price = stock_data['Adj Close'].iloc[-1]

ytd_performance = (last_closed_price / start_price - 1) * 100

# Create a DataFrame for each company

df = pd.DataFrame({

'Ticker': [ticker],

'Start Price': [start_price],

'Last Closed Price': [last_closed_price],

'YTD Performance': [ytd_performance]

})

# Append the DataFrame to the list

dfs.append(df)

# Concatenate all DataFrames into a single DataFrame

results_df = pd.concat(dfs, ignore_index=True)

# Sort the DataFrame by YTD Performance

results_df = results_df.sort_values(by='YTD Performance', ascending=False)

# Create and display the summary

results_df = results_df.sort_values(by='YTD Performance', ascending=False)

# Call the plotting functions and summarize returns

summarize_returns(results_df)Resulting summary will look like this

Most macroeconomic analysis lives at one of two extremes: This project sits somewhere in the middle. I wanted a clear,...

As part of a larger NLP project focused on analyzing shareholder communications, I needed a clean, consistent corpus of historical...

Working with SEC fundamentals data is powerful—but rarely simple. Raw filings are large, fragmented across periods, and difficult to transform...

All rights are reserved.