January 20, 2026/

Most macroeconomic analysis lives at one of two extremes: This project sits somewhere in the middle. I wanted a clear,...

This is the first post in a series to show working examples of trading bots using Alpaca.

A link to the notebook can be found on GitHub.

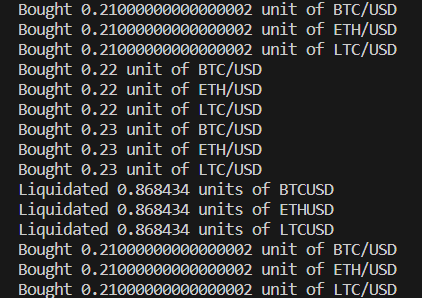

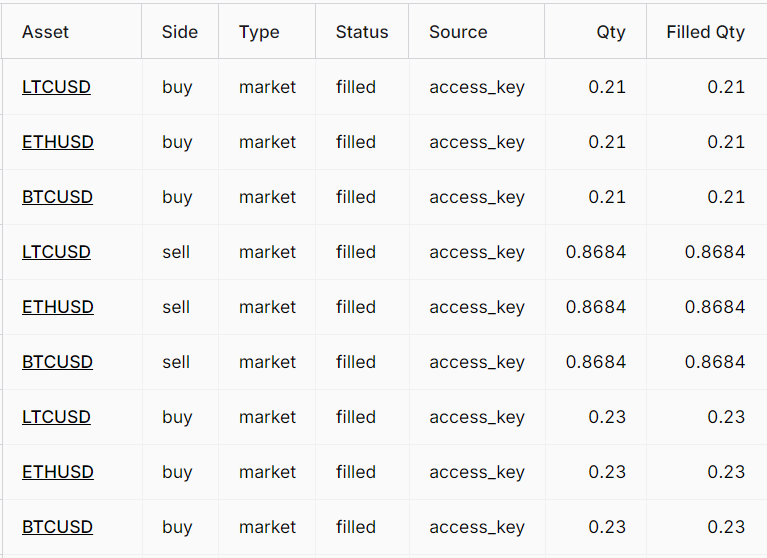

First I am going to provide a high level overview of the bot and then show a few key parts of the code. The bot does the following:

assets_to_buy = ["BTC/USD", "ETH/USD", 'LTC/USD'] # Replace with the assets you want to trade

# Additional Parameters

cycles = 3 # number of buy cycles before liquidating

buy_wait_time = 5 # wait time between buy cyclesasync def run_all():

while True: # Outer loop to continue after liquidation

i = 0.01 # this is so I can see different qtys

for _ in range(cycles):

buy_qty = 0.2 + i # this is so I can see different qtys

i += 0.01 # this is so I can see different qtys

await trading_strategy(buy_qty)

# Wait x seconds before the next buying cycle

await asyncio.sleep(buy_wait_time)

await liquidate_positions()

async def trading_strategy(buy_qty):

# Buy buy_qty shares of each asset every minute

for asset in assets_to_buy:

try:

# Place a market order to buy the specified quantity of the asset

api.submit_order(

symbol=asset,

qty=buy_qty,

side='buy',

type='market',

time_in_force='gtc'

)

print(f"Bought {buy_qty} unit of {asset}")

except Exception as e:

print(f"Failed to buy {asset}: {e}")

async def liquidate_positions():

# Liquidate all positions (including any bought outside of code)

positions = api.list_positions()

for position in positions:

try:

# Place a market order to sell the entire position

api.submit_order(

symbol=position.symbol,

qty=position.qty,

side='sell',

type='market',

time_in_force='gtc'

)

print(f"Liquidated {position.qty} units of {position.symbol}")

except Exception as e:

print(f"Failed to liquidate {position.symbol}: {e}")

Most macroeconomic analysis lives at one of two extremes: This project sits somewhere in the middle. I wanted a clear,...

As part of a larger NLP project focused on analyzing shareholder communications, I needed a clean, consistent corpus of historical...

Working with SEC fundamentals data is powerful—but rarely simple. Raw filings are large, fragmented across periods, and difficult to transform...

All rights are reserved.