Most macroeconomic analysis lives at one of two extremes: This project sits somewhere in the middle. I wanted a clear,...

This is a continuation in a series to show working examples of trading bots using Alpaca.

A link to the notebook can be found on GitHub.

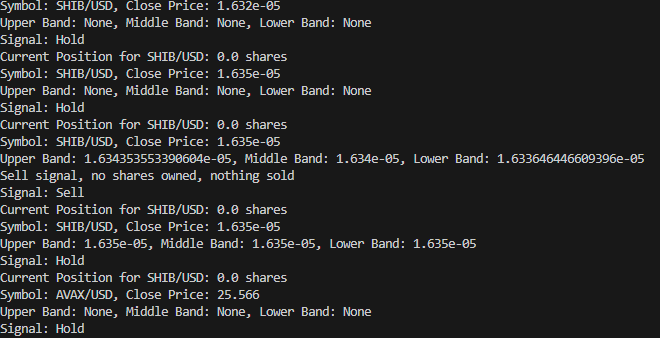

This trading bot streams websocket data, calculates Bollinger Bands for signals, and then buys/sells accordingly. It also logs the data so you can review what’s going on too.

An alternative version of this can be found here where the main difference is this current version uses TA Lib and the other does not. Sometimes it can be a difficult library to install, but sometimes it is useful too.

import asyncio

import websockets

import json

import talib

import numpy as np

import requests

import csv

import time

# Replace 'YOUR_API_KEY' and 'YOUR_API_SECRET' with your actual Alpaca API credentials

api_key = 'ENTER API KEY'

api_secret ='ENTER API SECRET'

base_url = 'https://paper-api.alpaca.markets'

# Define the assets you want to trade with slashes

assets_to_trade = ['AVAX/USD','BTC/USD', 'GRT/USD', 'ETH/USD', 'USDT/USD', 'CRV/USD',

'BAT/USD', 'BCH/USD', 'DOGE/USD', 'LINK/USD', 'MKR/USD', 'LTC/USD', 'UNI/USD', 'SHIB/USD',

'AAVE/USD', 'XTZ/USD', 'SUSHI/USD', 'YFI/USD', 'DOT/USD']

# assets_to_trade = ['BTC/USD', 'LTC/USD']

# Parameters for Bollinger Bands calculation

bollinger_periods = 3 # You can adjust this as needed

std_dev_multiplier = 0.25 # You can adjust this as needed

# User-defined parameters

quantity_to_buy = .61 # Specify the quantity to buy

run_time_minutes = 90 # Specify the run time in minutes

process_interval = 1 # Process every 1 data point by default

# Dictionary to store asset data

asset_data = {}

# Dictionary to store data counters for each symbol

data_counters = {}async def connect_to_websocket():

async with websockets.connect('wss://stream.data.alpaca.markets/v1beta3/crypto/us') as ws:

auth_data = {

"action": "auth",

"key": api_key,

"secret": api_secret

}

await ws.send(json.dumps(auth_data))

listen_message = {

"action": "subscribe",

"quotes": assets_to_trade,

}

await ws.send(json.dumps(listen_message))

# Initialize a timestamp to track the start time

start_time = time.time()

# Initialize the CSV file with headers

log_headers_to_csv('asset_data.csv')

while time.time() - start_time < run_time_minutes * 60: # Run for specified minutes

try:

message = await ws.recv()

# print(message)

data = json.loads(message)

if isinstance(data, list):

for item in data:

if 'T' in item and item['T'] == 'q': # Check if it's a quote message

symbol = item['S']

close_price = float(item['bp'])

timestamp = item['t']

if symbol not in assets_to_trade:

continue

# Create a dictionary to store asset data if it doesn't exist

if symbol not in asset_data:

asset_data[symbol] = {

'close_prices': [],

'upper_band': None,

'middle_band': None,

'lower_band': None,

'signal': None,

'shares_owned': 0.0

}

data_counters[symbol] = 0

data_counters[symbol] += 1

# Filter data based on process_interval

if not should_process_data(symbol, timestamp, process_interval):

continue

# Add the close price to the list

asset_data[symbol]['close_prices'].append(close_price)

# Keep only the last 'bollinger_periods' of close prices

if len(asset_data[symbol]['close_prices']) > bollinger_periods:

asset_data[symbol]['close_prices'].pop(0)

# Calculate Bollinger Bands using the close prices

upper_band, middle_band, lower_band = calculate_bollinger_bands(symbol)

asset_data[symbol]['upper_band'] = upper_band

asset_data[symbol]['middle_band'] = middle_band

asset_data[symbol]['lower_band'] = lower_band

print(f"Symbol: {symbol}, Close Price: {close_price}")

print(f"Upper Band: {upper_band}, Middle Band: {middle_band}, Lower Band: {lower_band}")

# Add Buy/Sell signals based on Bollinger Bands

signal = calculate_buy_sell_signal(symbol, close_price)

asset_data[symbol]['signal'] = signal

print(f"Signal: {signal}")

# Fetch and print the current position

position = fetch_current_position(symbol)

print(f"Current Position for {symbol}: {position} shares")

# Log the message to the CSV file

log_message_to_csv('asset_data.csv', timestamp, symbol, close_price, upper_band, middle_band, lower_band, signal)

except Exception as e:

print(f"Error: {e}")# Function to determine if data should be processed based on the interval

def should_process_data(symbol, timestamp, interval):

global data_counters

if symbol in data_counters and data_counters[symbol] % interval == 0:

return True

return False

# Function to initialize the CSV file with headers

def log_headers_to_csv(filename):

try:

with open(filename, 'w', newline='') as csvfile:

fieldnames = ['Timestamp', 'Symbol', 'Close Price', 'Upper Band', 'Middle Band', 'Lower Band', 'Signal']

writer = csv.DictWriter(csvfile, fieldnames=fieldnames)

writer.writeheader()

except Exception as e:

print(f"Error initializing CSV headers: {e}")

# Function to log messages to the CSV file

def log_message_to_csv(filename, timestamp, symbol, close_price, upper_band, middle_band, lower_band, signal):

try:

with open(filename, 'a', newline='') as csvfile:

fieldnames = ['Timestamp', 'Symbol', 'Close Price', 'Upper Band', 'Middle Band', 'Lower Band', 'Signal']

writer = csv.DictWriter(csvfile, fieldnames=fieldnames)

writer.writerow({

'Timestamp': timestamp,

'Symbol': symbol,

'Close Price': close_price,

'Upper Band': upper_band,

'Middle Band': middle_band,

'Lower Band': lower_band,

'Signal': signal

})

except Exception as e:

print(f"Error logging message to CSV: {e}")

def calculate_bollinger_bands(symbol):

if symbol in asset_data:

close_prices = asset_data[symbol]['close_prices']

if len(close_prices) >= bollinger_periods:

close_prices = np.array(close_prices[-bollinger_periods:]) # Use the last 'bollinger_periods' close prices

upper_band, middle_band, lower_band = talib.BBANDS(close_prices, timeperiod=bollinger_periods, nbdevup=std_dev_multiplier, nbdevdn=std_dev_multiplier)

return upper_band[-1], middle_band[-1], lower_band[-1]

return None, None, None

def calculate_buy_sell_signal(symbol, close_price):

if symbol in asset_data:

close_prices = asset_data[symbol]['close_prices']

if len(close_prices) >= bollinger_periods:

upper_band, middle_band, lower_band = calculate_bollinger_bands(symbol)

current_position = fetch_current_position(symbol)

if close_price > upper_band:

signal = "Sell" # Price crossed above upper band, indicating a Sell signal

elif close_price < lower_band:

signal = "Buy" # Price crossed below lower band, indicating a Buy signal

else:

signal = "Hold"

if signal == "Buy" and current_position == 0.0:

print("Buy signal, no shares owned, shares purchased")

# Buy logic here

buy_assets(symbol, quantity_to_buy)

elif signal == "Buy" and current_position > 0.0:

print("Buy signal, shares owned, no additional shares purchased")

# No additional buy logic here

elif signal == "Sell" and current_position == 0.0:

print("Sell signal, no shares owned, nothing sold")

# No sell logic here

elif signal == "Sell" and current_position > 0.0:

print(f"Sold {current_position} {symbol} shares")

# Sell logic here

sell_assets(symbol, current_position)

return signal

return "Hold" # No Buy/Sell signal

def fetch_current_position(symbol):

try:

# Remove the slash ("/") from the symbol when fetching the position

cleaned_symbol = symbol.replace("/", "")

response = requests.get(f'{base_url}/v2/positions/{cleaned_symbol}', headers={'APCA-API-KEY-ID': api_key, 'APCA-API-SECRET-KEY': api_secret})

if response.status_code == 200:

data = response.json()

return float(data['qty']) # Convert the quantity to a float

else:

return 0.0 # Treat errors as a position of 0

except Exception as e:

print(f"Error fetching position: {e}")

return 0.0

def buy_assets(symbol, quantity):

try:

# Buy assets using Alpaca API

cleaned_symbol = symbol.replace("/", "")

order_data = {

"symbol": cleaned_symbol,

"qty": quantity,

"side": "buy",

"type": "market",

"time_in_force": "gtc"

}

response = requests.post(f'{base_url}/v2/orders', json=order_data, headers={'APCA-API-KEY-ID': api_key, 'APCA-API-SECRET-KEY': api_secret})

if response.status_code == 201:

asset_data[symbol]['shares_owned'] += quantity

print(f"Bought {quantity} {symbol} shares")

else:

print(f"Error buying {quantity} {symbol} shares: {response.text}")

except Exception as e:

print(f"Error buying {quantity} {symbol} shares: {e}")

def sell_assets(symbol, quantity):

try:

# Sell assets using Alpaca API

cleaned_symbol = symbol.replace("/", "")

order_data = {

"symbol": cleaned_symbol,

"qty": quantity,

"side": "sell",

"type": "market",

"time_in_force": "gtc"

}

response = requests.post(f'{base_url}/v2/orders', json=order_data, headers={'APCA-API-KEY-ID': api_key, 'APCA-API-SECRET-KEY': api_secret})

if response.status_code == 201:

asset_data[symbol]['shares_owned'] -= quantity

print(f"Sold {quantity} {symbol} shares")

else:

print(f"Error selling {quantity} {symbol} shares: {response.text}")

except Exception as e:

print(f"Error selling {quantity} {symbol} shares: {e}")

if __name__ == "__main__":

asyncio.run(connect_to_websocket())

Most macroeconomic analysis lives at one of two extremes: This project sits somewhere in the middle. I wanted a clear,...

As part of a larger NLP project focused on analyzing shareholder communications, I needed a clean, consistent corpus of historical...

Working with SEC fundamentals data is powerful—but rarely simple. Raw filings are large, fragmented across periods, and difficult to transform...

All rights are reserved.