January 20, 2026/

Most macroeconomic analysis lives at one of two extremes: This project sits somewhere in the middle. I wanted a clear,...

This is the second post in a series to show working examples of trading bots using Alpaca.

A link to the notebook can be found on GitHub.

First I am going to provide a high level overview of the bot and then show a few key parts of the code. The bot does the following:

def calculate_rsi(data, periods, close_column):

df = pd.DataFrame(data)

try:

price_diff = df[close_column].diff(1)

gain = price_diff.where(price_diff > 0, 0)

loss = -price_diff.where(price_diff < 0, 0)

avg_gain = gain.rolling(window=periods).mean()

avg_loss = loss.rolling(window=periods).mean()

rs = avg_gain / avg_loss

rsi = 100 - (100 / (1 + rs))

df['RSI'] = rsi

except KeyError as e:

print(f"Error: {e}")

print(f"Close column '{close_column}' not found in data.")

return None

return df['RSI']

def calculate_buy_sell_signal_rsi(data, periods, thresholds, close_column='Adj Close'):

data['RSI'] = calculate_rsi(data, periods, close_column)

signals = pd.DataFrame(index=data.index)

signals['Signal'] = 'HOLD'

signals.loc[data['RSI'] > thresholds['overbought_threshold'], 'Signal'] = 'SELL'

signals.loc[data['RSI'] < thresholds['oversold_threshold'], 'Signal'] = 'BUY'

return signals, data['RSI'], periodsdef connect_to_yfinance(assets, interval, lookback_days=60):

historical_data = {}

end_date = datetime.now()

start_date = end_date - timedelta(days=lookback_days)

for symbol in assets:

data = yf.download(symbol, interval=interval, start=start_date, end=end_date)

historical_data[symbol] = data

return historical_data

def fetch_current_position(symbol):

try:

response = requests.get(f'{base_url}/v2/positions/{symbol}', headers={'APCA-API-KEY-ID': api_key, 'APCA-API-SECRET-KEY': api_secret})

if response.status_code == 200:

data = response.json()

return float(data['qty'])

else:

return 0.0

except Exception as e:

print(f"Error fetching position: {e}")

return 0.0

def buy_assets(symbol, quantity):

try:

order_data = {

"symbol": symbol,

"qty": quantity,

"side": "buy",

"type": "market",

"time_in_force": "gtc"

}

response = requests.post(f'{base_url}/v2/orders', json=order_data, headers={'APCA-API-KEY-ID': api_key, 'APCA-API-SECRET-KEY': api_secret})

if response.status_code == 201:

print(f"Bought {quantity} {symbol} shares")

else:

print(f"Error buying {quantity} {symbol} shares: {response.text}")

except Exception as e:

print(f"Error buying {quantity} {symbol} shares: {e}")

def sell_assets(symbol, quantity):

try:

order_data = {

"symbol": symbol,

"qty": quantity,

"side": "sell",

"type": "market",

"time_in_force": "gtc"

}

response = requests.post(f'{base_url}/v2/orders', json=order_data, headers={'APCA-API-KEY-ID': api_key, 'APCA-API-SECRET-KEY': api_secret})

if response.status_code == 201:

print(f"Sold {quantity} {symbol} shares")

else:

print(f"Error selling {quantity} {symbol} shares: {response.text}")

except Exception as e:

print(f"Error selling {quantity} {symbol} shares: {e}")def main():

assets_to_trade = ['AAPL', 'GOOGL']

interval = '1h'

lookback_days = 60

rsi_periods = 14

overbought_threshold = 70

oversold_threshold = 30

quantity_to_buy = 5

thresholds = {

'overbought_threshold': overbought_threshold,

'oversold_threshold': oversold_threshold

}

historical_data = connect_to_yfinance(assets_to_trade, interval, lookback_days)

for symbol in assets_to_trade:

data = historical_data[symbol]

signals, rsi_values, periods = calculate_buy_sell_signal_rsi(data, rsi_periods, thresholds)

current_position = fetch_current_position(symbol)

last_signal = signals['Signal'].iloc[-1]

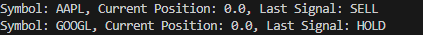

print(f"Symbol: {symbol}, Current Position: {current_position}, Last Signal: {last_signal}")

if last_signal == 'BUY' and current_position == 0:

buy_assets(symbol, quantity_to_buy)

elif last_signal == 'SELL' and current_position > 0:

sell_assets(symbol, current_position)

if __name__ == "__main__":

main()

Most macroeconomic analysis lives at one of two extremes: This project sits somewhere in the middle. I wanted a clear,...

As part of a larger NLP project focused on analyzing shareholder communications, I needed a clean, consistent corpus of historical...

Working with SEC fundamentals data is powerful—but rarely simple. Raw filings are large, fragmented across periods, and difficult to transform...

All rights are reserved.