January 20, 2026/

Most macroeconomic analysis lives at one of two extremes: This project sits somewhere in the middle. I wanted a clear,...

I am going to show how to create a python screener that pulls OHLC data from Yahoo Finance and then calculates buy/sell signals for the following indicators. Please note: the three bullets below are Investopedia links should you need more information

# import libraries

import yfinance as yf

import pandas as pd

from datetime import datetime, timedelta

# Define the symbols and date range

symbols = ['MMM', 'AAPL', 'GOOGL'] # Example list of symbols

start_date = '2022-12-01'

# Get the current date

current_date = datetime.today()

end_date = (current_date - timedelta(days=1)).strftime('%Y-%m-%d')

# Create an empty list to store the results

results = []

# Loop over each symbol

for symbol in symbols:

# Fetch OHLC data from Yahoo Finance

data = yf.download(symbol, start=start_date, end=end_date)

# Calculate SMA

period = 20

data['SMA'] = data['Close'].rolling(window=period, min_periods=20).mean()

# Calculate RSI

period = 14

delta = data['Close'].diff()

gain = delta.where(delta > 0, 0)

loss = -delta.where(delta < 0, 0)

avg_gain = gain.rolling(window=period).mean()

avg_loss = loss.rolling(window=period).mean()

relative_strength = avg_gain / avg_loss

data['RSI'] = 100 - (100 / (1 + relative_strength))

# Calculate Bollinger Bands

period = 20

std_dev = data['Close'].rolling(window=period).std().shift(1)

data['Upper Band'] = data['SMA'] + 2 * std_dev

data['Middle Band'] = data['SMA']

data['Lower Band'] = data['SMA'] - 2 * std_dev

# Calculate Signal columns

data['SMA Signal'] = ''

data['RSI Signal'] = ''

data['BB Signal'] = ''

data.loc[data['SMA'] > data['Close'], 'SMA Signal'] = 'Sell'

data.loc[data['SMA'] < data['Close'], 'SMA Signal'] = 'Buy'

data.loc[data['SMA'] == data['Close'], 'SMA Signal'] = 'Neutral'

data.loc[data['RSI'] > 70, 'RSI Signal'] = 'Sell'

data.loc[data['RSI'] < 30, 'RSI Signal'] = 'Buy'

data.loc[(data['RSI'] >= 30) & (data['RSI'] <= 70), 'RSI Signal'] = 'Neutral'

data.loc[(data['Close'] < data['Lower Band']) & (data['RSI'] < 30), 'BB Signal'] = 'Buy'

data.loc[(data['Close'] > data['Upper Band']) & (data['RSI'] > 70), 'BB Signal'] = 'Sell'

data.loc[((data['Close'] >= data['Lower Band']) & (data['Close'] <= data['Middle Band'])) | ((data['Close'] <= data['Upper Band']) & (data['Close'] >= data['Middle Band'])), 'BB Signal'] = 'Neutral'

# Calculate Buy, Sell, and Neutral Signal counts

data['Buy Signal'] = (data['SMA Signal'] == 'Buy').astype(int) + (data['RSI Signal'] == 'Buy').astype(int) + (data['BB Signal'] == 'Buy').astype(int)

data['Sell Signal'] = (data['SMA Signal'] == 'Sell').astype(int) + (data['RSI Signal'] == 'Sell').astype(int) + (data['BB Signal'] == 'Sell').astype(int)

data['Neutral Signal'] = (data['SMA Signal'] == 'Neutral').astype(int) + (data['RSI Signal'] == 'Neutral').astype(int) + (data['BB Signal'] == 'Neutral').astype(int)

# Add the symbol and its data to the results list

results.append({'Symbol': symbol, 'Data': data})

# Convert results to dataframes

dataframes = []

for result in results:

symbol = result['Symbol']

data = result['Data']

dataframe = pd.DataFrame(data)

dataframe['Symbol'] = symbol

dataframes.append(dataframe)

# Combine all dataframes into a single dataframe

combined_dataframe = pd.concat(dataframes)

# combined_dataframe.head(35)

# Sort by Symbol and then Date descending

combined_dataframe.sort_values(by=['Symbol', 'Date'], ascending=[True, False], inplace=True)

# Display the combined dataframe

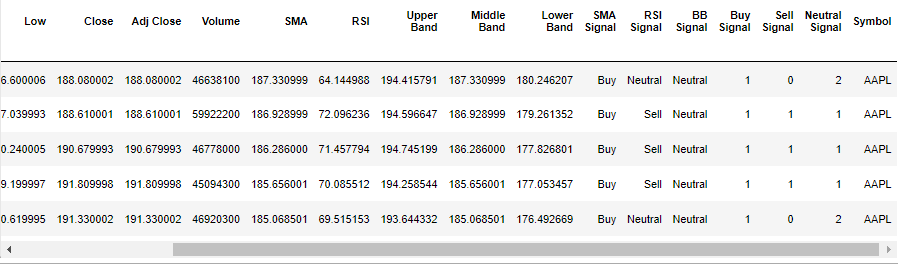

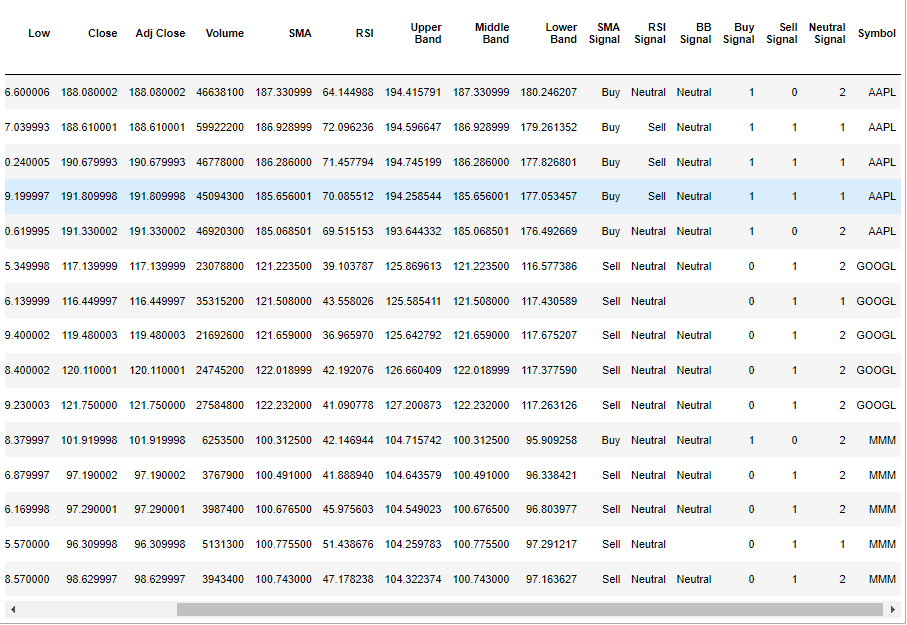

combined_dataframe.head()

# Sort the combined_dataframe by 'Symbol' and 'Date'

sorted_dataframe = combined_dataframe.sort_values(by=['Symbol', 'Date'], ascending=[True, False])

# Extract the most recent 5 days of data per ticker

grouped_dataframe = sorted_dataframe.groupby('Symbol').head(5)

print("Most recent 5 days of data per ticker:")

grouped_dataframe

Most macroeconomic analysis lives at one of two extremes: This project sits somewhere in the middle. I wanted a clear,...

As part of a larger NLP project focused on analyzing shareholder communications, I needed a clean, consistent corpus of historical...

Working with SEC fundamentals data is powerful—but rarely simple. Raw filings are large, fragmented across periods, and difficult to transform...

All rights are reserved.